tax avoidance vs tax evasion nz

People who cheat the tax system are tax criminals. New Zealand has had a general anti-avoidance provision since The Property Assessment Act 1879 s 29.

A planning made to reduce the tax burden without infringement of the legislature is known as Tax Avoidance.

. On 17 December 2020 Inland Revenue issued a draft interpretation statement - Tax Avoidance and the interpretation of the general anti-avoidance provisions section BG 1 and GA 1 of the Income Tax Act 2007 Draft IS. Basically tax avoidance is legal while tax evasion is not. For example when people.

Tax evasion means concealing income or information from tax authorities and its illegal. Tax avoidance refers to hedging of tax but tax evasion implies the suppression of tax. The intention behind tax avoidance is to optimise and reduce ones tax liability whereas the intention behind tax evasion is to deliberately evade paying taxes which are actually owed.

Logan says its important to distinguish between tax avoidance and evasion. Tax evasion includes underreporting income not filing tax returns and purposely underpaying taxes. Claim more business expenses than they really had so they pay less tax on their income.

Tax Evasion refers to the adoption of illegal methods for reducing liability of payment of taxes such as manipulation of business accounts understating of incomes or overstating of expenses etc whereas Tax Avoidance is the legal way to reduce the tax liability by following the methods that are allowed in the income tax laws of the country such as taking permissible deductions etc. Tax crime happens when people cheat the tax system through deliberate and dishonest behaviour so they can get some kind of financial benefit. Each year after tax season ends the IRS reveals a Dirty Dozen list.

There is a common misunderstanding that differentiates between tax avoidance and tax evasion by claiming that avoidance is legal and evasion is illegal the implication being that if youre only avoiding tax you wont have any trouble. What tax crime is Everyone pays tax on their income to help fund public services. Businesses get into trouble with the IRS when they intentionally evade taxes.

Genuine mistakes on a tax return such as misculautions and missed deadlines can also be considered tax avoidance. Carter evades the onrushing Habana passes to Gear who avoids a couple of Boks. Since the inception of the income tax the difference of opinion between a taxpayer and the tax collector has always been and will always remain.

The main difference between a form of tax evasion vs avoidance is whether the action taken to reduce ones tax burden is illegal. While tax avoidance and tax evasion are both centred around avoiding paying taxes they are very different. In addition three QWBAs were withdrawn QB 1411 QB 1501 and QB 1511 with aspects of the QWBAs being reconsulted on.

Getting your tax right Its easier to get your tax right when you plan ahead. Tax evasion is the general term for efforts by taxpayers to evade the payment of taxes by illegal means. In the tax world however there is a very clear distinction between tax avoidance and tax evasion a point highlighted by the Minister of Revenues remark about legitimate tax avoidance in the recent.

On the other hand tax evasion involves deliberately. By Terry Baucher. How we deal with tax crime Were committed to dealing with people who deliberately avoid pay their fair share of tax including prosecuting them if needed.

Avoidance versus evasion and is there a difference. Tax avoidance sometimes takes advantage of legal loopholes and can be at the fringes of what is. Any form of tax evasion tends to be explicitly illegal according to the tax code.

A taxpayer by all means wants to minimise its tax liability whereas the tax collector maximise. The reality is more complex. Claim money theyre not entitled to.

Its a compilation of the biggest schemes that IRS agents saw that year and the agency releases the list to help taxpayers avoid falling victim to the same scams next year. Tax avoidance is legal whereas tax evasion is illegal and fraudulent. Put simply tax evasion is illegal while tax avoidance is completely legal.

Tax avoidance means legally reducing your taxable income. Tax evasion is a serious offense and those found guilty can be fined andor jailed. In tax evasion you hide or lie about your income and assets altogether.

The following are the major differences between Tax Avoidance and Tax Evasion. In tax avoidance you structure your affairs to pay the least possible amount of tax due. To start with tax avoidance is legal while tax evasion is illegal.

Essentially tax evasion is illegal and tax avoidance is unacceptable and can be illegal whereas tax minimisation is acceptable and legal. Tax mitigation is not a term of art14 and recently the New Zealand Supreme Court has said the mitigationavoidance. Tax avoidance is taking advantage of credits and deductions and saving for retirement.

But your business can avoid paying taxes and your tax preparer can help you do that. To summarise tax avoidance is a legal and legitimate strategy while tax evasion is illegal and results in harsh punishments. An unlawful act done to avoid tax payment is known as Tax Evasion.

19 hours agoThe difference between tax avoidance and tax evasion is that tax avoidance schemes operate within the law but are described by HMRC as not being in the spirit of the law. The difference between tax avoidance and tax evasion boils down to the element of concealing. While you get reduced taxes with tax avoidance tax evasion can result in fines penalties imprisonment or.

The IRD as a matter of policy allows all taxpayers of New Zealand to. Tax avoidance schemes make use of loopholes or deliberate lawmaker decisions to reduce ones tax burden. Tax evasion can lead to a federal charge fines or jail time.

In other words tax evasion can be generally defined as the direct violation of a tax provision. Being convicted of tax evasion can have a variety of consequences from shortfall penalties to imprisonment13 B Tax mitigation On the opposite end of the scale to tax evasion is tax mitigation. In ordinary use avoid and evade are interchangeable.

A further sub-set of tax aggressiveness is tax avoidance which refers to tax planning activities that have a low level of probability less than 50 of. What tax crime is.

Tax Evasion From Cross Border Fraud Does Digitalization Make A Difference In Imf Working Papers Volume 2020 Issue 245 2020

How Raising Tax For High Income Earners Would Reduce Inequality Improve Social Welfare In New Zealand

Estimating International Tax Evasion By Individuals

Explainer The Difference Between Tax Avoidance And Evasion

Solution Taxation Principles And Theory Chapter1 Studypool

Investopedia Video Tax Avoidance Vs Tax Evasion Youtube

The State Of Tax Justice 2020 Eutax

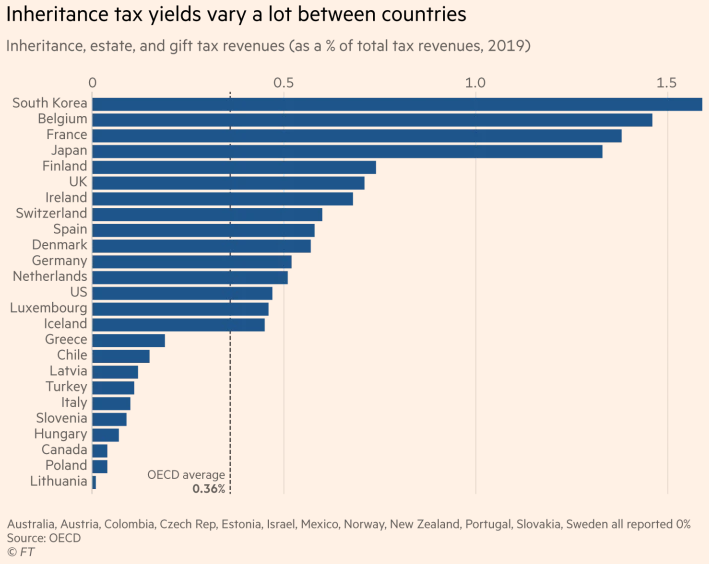

Inheritance Tax Debate What The Wealthy Need To Know

Mobility Basics What Are Tax Equalisation And Tax Protection Eca International

Requalification Of Tax Avoidance Into Tax Evasion

Tax Avoidance Vs Tax Evasion Infographic Fincor

Despite The Tough Talk This Government Is Far Too Soft On Tax Evasion Chris Huhne The Guardian

Tax Evasion And Tax Avoidance Explained Pdf Tax Avoidance And Tax Evasion Explained And Studocu

Estimating International Tax Evasion By Individuals

Explainer What S The Difference Between Tax Avoidance And Evasion